COVID-19 has expedited fundamental changes in the retail and CPG industries that will last into the ‘New Normal’. Physical retailers have already felt this pressure, and many have not fared well – Zara recently announced the closing of 1,000 stores while J Crew, Neiman Marcus, and JC Penny have all filed for chapter 11 bankruptcy, among many other retail icons.

The pandemic has driven even the strongest leaders to innovate the way they do business – not just opportunistic innovation capitalizing on low hanging fruit, but systematic, responsive innovation that uses proven innovation processes to fundamentally evolve the way they operate. While pursuing these responsive innovations, these leaders have had to focus their efforts. Walmart focused on 5 crisis priorities. Above all, they put their employees’ well-being first. By making sure their frontline associates were supported with special cash bonuses, accelerated payments, reduced store hours, and the hiring of 235,000 temporary associates in the US, Walmart became the go-to pandemic channel.

Thanks to their pragmatic approach to innovating the way they operate, consumers are streaming through their doors and Walmart has been able to further experiment their way to success. For example, new customers have been testing out Walmart’s store pick-up options and delivery has already increased 4X since the initial onset of the COVID-19 crisis mid-March. In response, they have expanded slot capacity and their available portfolio of offerings. As a result, their US e-Commerce business grew 97% in Q2. In part through these innovations, Walmart experienced US comp growth of 9.2% in Q2, while Sam’s Club experienced 16% growth as an initial bump due to COVID-19.

Consumers are rapidly adopting digital options and trying new brands and channels (read: digital) as they try to access the products they need. A recent PwC Consumer Insights study revealed that 50% of consumers are trying new brands or products. More importantly, these consumers are willing to have a relationship after the pandemic with companies that serve them well. As a result, businesses are identifying trends, being more aggressive experimenting their way towards a solution, and using customers as beta testers.

We all know the traditional giants are regaining the upper hand against the balance of retailers during the pandemic. Walmart and Amazon have seen material growth in their online sales. This is a story of how emerging and mid-size retailers can also win using the same basic principles. Innovating new ways to provide a safe manner for your employees to transact and serve and for your customers to obtain product and services, while quickly sensing and responding to their needs.

5 key trends accelerated by COVID-19

Our recent PwC CFO/Consumer survey and market insights highlighted 5 key trends that have been accelerated by the pandemic. We believe these will carry into the ‘New Normal’ and players need to begin adapting to them now.

|

Shift to Working and Living Virtually

|

|

Increased Focus on Improving Home Living

|

|

Increased Reliance on Digital

|

|

Reduced Commuting Trips

|

|

Physical Retail Reckoning

|

The silver lining in the pandemic is that it has amplified urgency around customer empathy, as companies embrace change to established innovation disciplines to help reinvent themselves.

The changes required are systemic and multidisciplinary

They will require continuous adaptation across business functions and capabilities

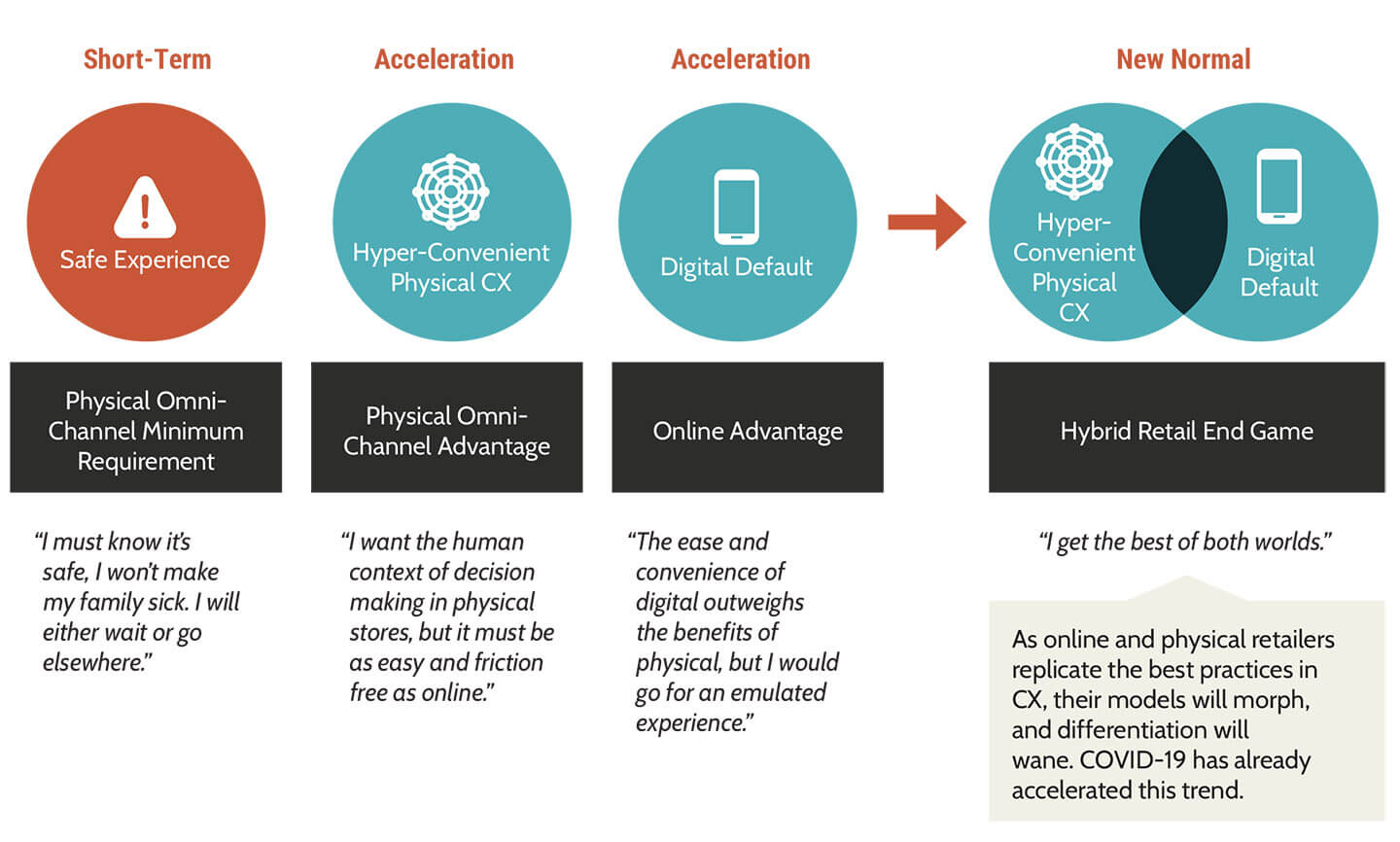

New short-term safety concerns have led to financial uncertainty and changes in customer behaviors in the retail space. This will accelerate the trends discussed earlier, creating new consumer and customer expectations and requiring players to rethink their operating models from the ground up.

Continuous adaptation will be required across business operations, customer experience, real-estate, channel strategy, training, and technology. In the short term, businesses must ensure a safe experience for their customers and consumers. At the same time, they must accelerate the move to a Hyper Convenient Physical Customer Experience (CX), while shifting towards a digital default.

In the mid-to long-term, the majority of online and physical retailers will replicate best practices in CX. Their models will morph and the differentiation capabilities that set certain players above the rest in the short-term will be diminished. We are already seeing COVID-19 accelerate this trend to the ‘New Normal’-a seamless, hybrid retail end-game.

The role of Innovation + Strategy is being reinvented

Innovation + strategy is now the go-to method to quickly address holistic impacts and opportunities created by COVID-19

The pandemic has made the world more patient and forgiving as businesses adjust. This will not last. Now is the time to make the tough decisions-retire old business models and rebuild a more agile and digital company. This reinvention can be approached in 3 phases:

The short term: Involve & Solve the Crisis

- Systematically engage leaders & frontline in scrum-like problem solving, while investing in real-time customer trends data to curate targeted needs-based offerings

- Harvest data from new and lost customers. Meet their developing channel needs

- Perform a ruthless assessment of your real estate to identify what you truly need

- Use technology to enable/validate safe and clean services. Shift transactions/marketing from physical to frictionless, cashier-less digital

- Accelerate operational leaps by rewiring your innovation approach, standing up new verticals as needed

The Mid Term: Invent & Iterate Your Future

- Build a system to experiment, execute, & iterate faster, using customers become beta users of MVP

- Use store physical assets to accelerate path to same day home delivery and lower shipping costs while killing outdated operating models and transforming supply chain

- Accelerate toward a virtual CX while emulating the start-up ‘low-asset’ culture

- Establish a strategic blueprint and initiative portfolio to transform your organization

The Long Term: Implement Your New Normal

- As society grows accustomed to the ‘New Normal’, consumer spending habits will begin to normalize in new areas, such as shifting retail traffic to an online format

- Operate like a start-up by making urgency systematic in your organization-scale your new strategy and vision

- Normalize new operating and supply chain models you developed in the mid term

- Identify operational processes that can by digitized and focus on developing technology that enables a direct to consumer approach

- Prioritize and scale your transformational plays

Pragmatic Innovation will be critical for long term success

A robust, repeatable Pragmatic Innovation capability will differentiate players in an era when change is faster than ever

Why Pragmatic Innovation now?

71% of business leaders from companies with $1B+ in revenue said they view this crisis as an opportunity to emerge stronger – particularly in product and service innovations. Those that seize this opportunity will thrive in the ‘New Normal’.

How do I approach Pragmatic Innovation?

We have synthesized the 8 Elements of Pragmatic Innovation which businesses should adhere to in order to come out of this pandemic on top:

- Listen with Urgency: Direct involvement from you, your customers, and your employees will dispel ambiguity and help de-risk solutions

- Speed & Agility: Move! Prioritize speed over precision. Move with urgency and agility using live ammo to iterate and decide with an MVP mindset, adjusting to shifting customer needs

- Adaptive Portfolio: Re-prioritize portfolio with a crisis lens, overweighting near-term actionable initiatives while pausing/ preserving long-term growth options

- Innovation Process Techniques: Adapt Proven innovation processes (Agile, Lean, Design Thinking) to ensure execution consistency across initiatives

- Operator + Innovator Talent: Pragmatic innovation is best delivered by your top operators who possess the aptitude and passion to be innovators.

- Governance: A strong foundation for growth requires governance to force action across the portfolio for both innovation teams and lines of business.

- Open Innovation: Utilize partnerships to share costs and potential value. This “syndicates” risk and reward across strategic and financial partners

- Most importantly, be opportunistic: Never waste a crisis. Identify new adjacent & transformational opportunities, including moonshots created by the pandemic

Let us help invent your new normal

Have you clearly defined how you will capitalize on the opportunity to reinvent your business in this time of uncertainty?

We can help. Move with conviction and move faster based on what your customers want.